W D Gann Pdf

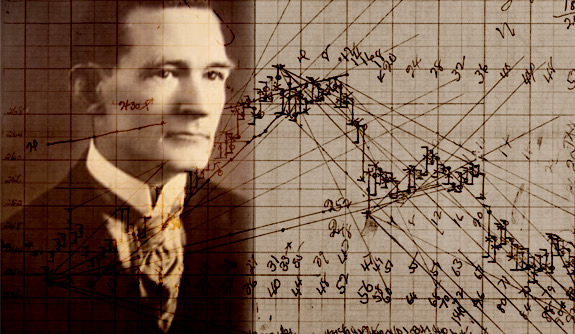

THE MASTER TIME FACTOR. This E-Book is not to be sold. It is a free educational service in the public interest published. Gann Study Group. Rediscovering W. Gann’s method of forecasting the financial markets By James Smithson 1. Introduction William Delbert Gann (1878 -1955) was a successful stocks and commodities trader. He also wrote seven books and numerous short courses on how to trade successfully. Train to busan subtitles english download. However, Gann’s unique skill was the way in which he accurately.

- After over 50-Years of Research, Work, Testing and still more Research, I've distilled the essence of the fundamental Laws of Markets and Prices that W.D. Gann explored in his writings and courses into a concise collection of Modules and Courses that are now being made more available to you than ever before.

- GANN MASTER STOCK MARKET COURSE Proudly presented for the educational benefit of the members of Wheels In The Sky. A forum where one can learn about Gann and other famous market forecasters.

W. D. GANN'S WHEEL OF 24, WHEEL OF 12, AND SQUARE OF 9

W. D. Gann is acclaimed for publishing mysterious numbered wheels and diagrams, which are attributed to the prediction of time and price. The wheels and constructs Gann published represented 'veiled reminders' of very powerful applications of the Law of Vibration which Gann previously taught orally to his students.

Only by understanding the hidden mathematical precepts and Law of Vibration behind these wheels and 'squares' can one use these wheels to predict price and time as W. D. Gann would. Gann successfully made predictions with these wheels by exclusively using them within the context of his other tools, such as the trend-predicting Arcana, Cycles of Progression, and Top & Bottom Finder,

Collected Writings Of W.d. Gann Pdf

If you are looking for a Gann Wheel of 24 or Square of 9 to alone predict when the market will go up and down and to what price it will go, please stop wasting your time and money on Gann folklore. W. D. Gann used wheels and squares in a much different way than commercial practitioners use the ones he published. Special settings, based on the Law of Vibration, are necessary to narrow down precision targets.

Click here for our short target and bounce projections in advance of the market through the Black Swan Crisis. These projections integrated the numbered squares and wheels with the Law of Vibration; as Gann projected specific targets and bounces. Download gta sa compressed pc.

W. D. Gann used the Wheel of 24, Wheel of 12, and the Square of 9 together. He actually has several functions for each numbered wheel and square. Each arrangement involved tuning to the market and timeframe using the Law of Vibration, and considering which other technique Gann paired the squares and wheels with.

The numbered wheels and squares we see in Gann's published works show the form, but never reveal the true function. Also, the construction of each wheel or square, along with each of their resistance points, can vary per each day, week, month, or year based on a preset formula grounded in the Law of Vibration.

Below are a couple consecutive days of JPM stock on an intraday 2min chart. JPM is a very old entity, and the vibration is little tricky to capture. Based on the Law of Vibration, each day's vibration can vary as well. Note the integration of both the Wheel of 24 in blue lines and Square of 9's 90 degree hashes in fuchsia. Scroll through and enlarge the 2 pictures in the gallery below.

JPM Square of Nine 5-31

On the above chart for 5-31, we see first notice that the 90 degree hashes in fuchsia are dead on for catching the resistance of price in the major moves of the day. The real vibration of JPM produces several resistance points. But the Wheel of 24 blue lines are fewer, and confirm major points of price confluence between the 2 techniques.

The lower blue line is where we would expect the first price resistance- the only real planetary opposition of the day. Now, let me underscore here that there is only 1 of these points, not 5 others. Situated very close to the 180 degree square of 9 reference, we would expect strong resistance here. Next, we find price 180 degrees opposite itself on the Wheel of 24 with the higher second blue line. Again, extremely close to the 270 degree Square of 9 point. We would also expect strong resistance here.

Follow the same example, the next slide shows blue Wheel of 24 lines at the same identical resistance points on June 3rd. Combining these two techniques is extremely reliable, but Gann went a step further and used his Top/Bottom Finder, price projections, and more to pinpoint exact ends of price runs and pullbacks. Our demonstrations of these techniques include special conversion factors dictated by Gann's formula for the Wheel of 24 and Square of 9 intraday. Without them they are inconsistent.

Sorry we are unable to show you the numbers behind the wheels or square of 9, but their ancient arrangement holds the secret. Anyway, the power lies in the visual representation on the chart.